Here we suspend judgement and reason. Briefly.

When you begin to think about a level of assets that are far above any individual person’s ability to consume you’re now talking about capital allocation. And it doesn’t make much sense to take the job of capital allocation away from those who have demonstrated great skill in that and give it to an entity that has demonstrated very poor skill in capital allocation, which is government.

Elon Musk

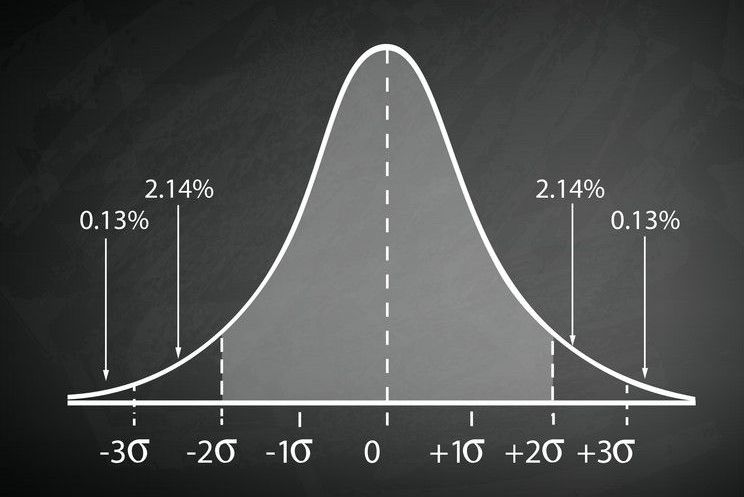

At life’s inception you are dropped somewhere on this distribution. From there, you can traverse it anyway you wish. Let’s rendezvous on the far right…

Technological Half Life

- Half life is the interval of time required for half of the atomic nuclei to decay. It is a characteristic property of unstable nuclei. Technology also has similar properties of decay analogous to social interest, functional interest, scaling interest (the absence of improvements to useability declines)

- Alpha decay – when unstable nuclei dissipate energy by ejecting an alpha particle; so too do incumbent technologies spit out more useful and iterative particles (think of iPhone 1st gen, 2nd gen, then sidekick, LG, etc

- Just as oil is facing decarbonization and use of alt energy sources, so too is Bitcoin facing network decay from numerous competing networks. Entropy lies at the network not the unit (as is the case with gold)

Valuation

- Essence of valuation is largely the expected return which is based on assumptions about the future. Technological half life is so important in the valuation step because you need to figure out how long will this last and what is the company’s ability to come up with new ideas, channels, and IP.

- Analog or Digital Approach

- Analog is the traditional way to measure value (PPE, cash flow [FCF/DCF]) whereas Digital is the platform/matchmaking IP/capital-less intermediary. Analog is already hard enough and filled with assumptions but increasingly complex to value digital

- Smart contracts allow enforceable rules and you are able to codify enforceability to these smart contracts

- Analog is the traditional way to measure value (PPE, cash flow [FCF/DCF]) whereas Digital is the platform/matchmaking IP/capital-less intermediary. Analog is already hard enough and filled with assumptions but increasingly complex to value digital

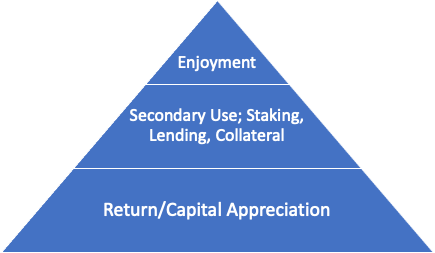

- Return is 1st order, 2nd order is asset optimization; what else can I do with this asset once I purchase it (stake it, lend it, collateralize it [currently can only really do as a professional or institutional individual])

- Maslow’s Hierarchy of Needs – there’s a similar structure for an investible asset. First most basic necessity is that it can earn a return. Art, collectibles, and other luxury items typically contain all three.